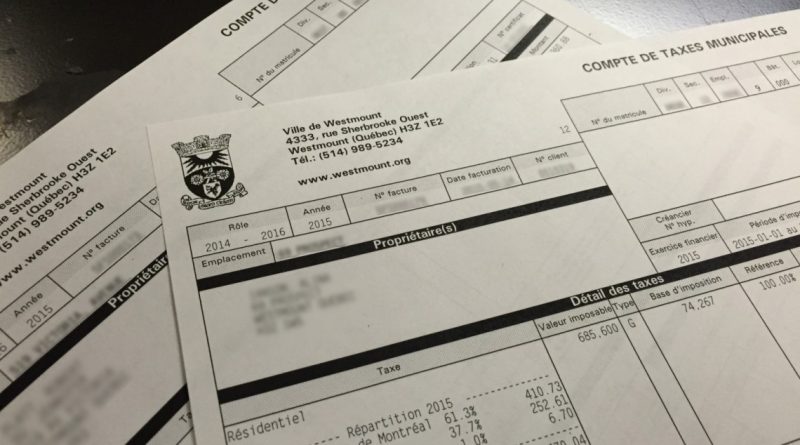

Reminder: Payment of property taxes

As the payment deadlines for both instalments of the annual property tax bills have passed, the City reminds property owners to ensure that their tax accounts are paid.

Please note that an interest rate of 9% per year will be charged on the outstanding balance of any overdue payment. A penalty of 0.5% per month on the outstanding principal will also be charged to a maximum of 5%, over and above the interest charges.

The Cities and Towns Act, s. 511, allows municipalities to recover unpaid taxes by means of sale of buildings for non-payment of taxes. This procedure should start in Autumn 2024.

How to consult your tax account

Property owners may consult their tax account via the City’s online property portal, Voilà!, or email the City’s Finance Department at taxation@westmount.org or by phone at 514 989-5234 (during office hours).

For more information methods of payment and taxation in general, please consult the Taxation page or call 514 989-5234.