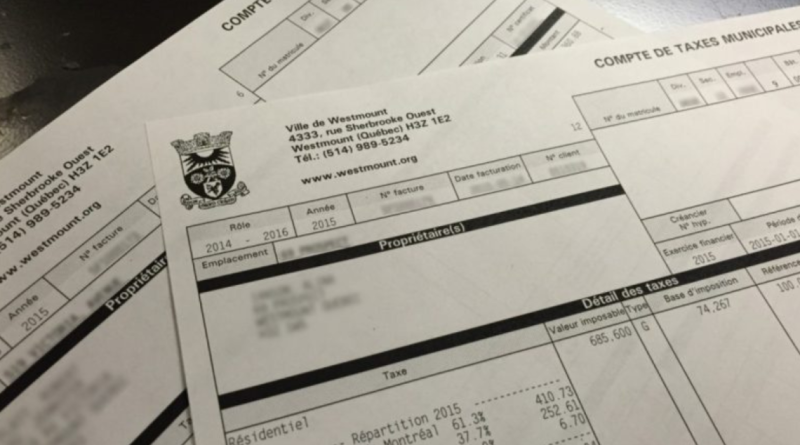

Reminder: Non-payment of property taxes

Each year, the City of Westmount prepares a list of properties for which property taxes remain unpaid (Cities and Towns Act, s. 511 and 512). In August 2024, the City’s Finance Department mailed one (1) reminder notice to the owners of the affected properties. On October 7, the City Clerk forwarded to the City Council the list of properties for which taxes remain unpaid. Council adopted a resolution ordering the publication and sale of the properties concerned.

IMPORTANT DATES

- October 31, 2024 at 4:30 p.m.: deadline for paying unpaid taxes by electronic payment and avoiding publication of the owner’s name in the 1st press notice.

- November 1st, 2024 at 10 a.m.: deadline for paying unpaid taxes in person at City Hall (4333 Rue Sherbrooke O.) and avoiding publication of the owner’s name in the 1st press notice.

- November 5, 2024: Publication in the press of a 2nd notice containing the list of properties for which property taxes remain unpaid.

- December 9, 2024: Sale by auction of properties for which property taxes remain unpaid.

The sale of properties for non-payment of taxes is carried out in accordance with the Cities and Towns Act. For more information on the payment of property taxes, visit www2.westmount.org/taxation-evaluation.