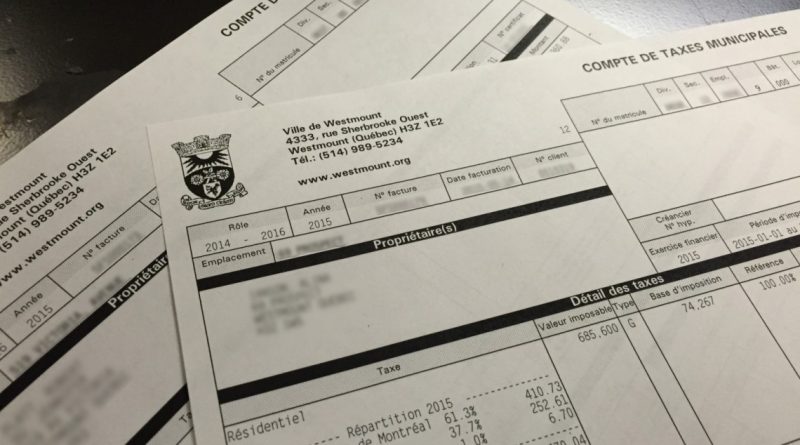

Property taxes: second instalment due May 26, 2023

IMPORTANT : because the summer office schedule will come into effect the week of May 23, Westmount City Hall will close at 1 p.m. on Friday, May 26.

The deadline for the second property tax instalment for 2023 is May 26.

Payment methods

Payments are accepted:

- electronically, through your bank online, by phone or at your branch

- by mail (cheque payable to the City of Westmount)

- in person at 4333 Sherbrooke Street West (cheque inserted in mail slot – NO CASH)

- by credit card by clicking here.

Penalties

Payment can be made in two instalments. An interest rate of 9% per annum will be charged on the unpaid balance. A penalty of 0.5% per month on the outstanding principal will also be charged to a maximum of 5%, over and above the interest charges.

Voilà! Your Online Property Portal

Property owners in the City can now receive and consult their tax bills online on Voilà!

Voilà! is an online portal developed by PG Solutions that allows the consolidation of information on a property’s taxation data, assessment notice, and tax details. This information is available to the citizen online at any time.

For more details, consult the Taxation & Valuation page or phone 514 989-5234.